From 1 January 2026, Belgium will require electronic invoicing (e-invoicing) for all VAT taxpayers. 2026 is tomorrow...

Through this article, we hope to popularise this new standard that will disrupt, for some, the management of your business and will require you to digitise it.

👨⚖️The position of Belgium on electronic invoicing

Although the obligation for electronic invoicing at the European level is scheduled for 2028, Belgium has chosen to bring this date forward. The Belgian government has decided to implement it as of 1 January 2026, specifically within a B2B (Business-to-Business) framework.

This obligation has been in effect since 2008 for publicly listed companies and since 1 March 2024 for B2G (Business-to-Government).

🌐Peppol? What is it?

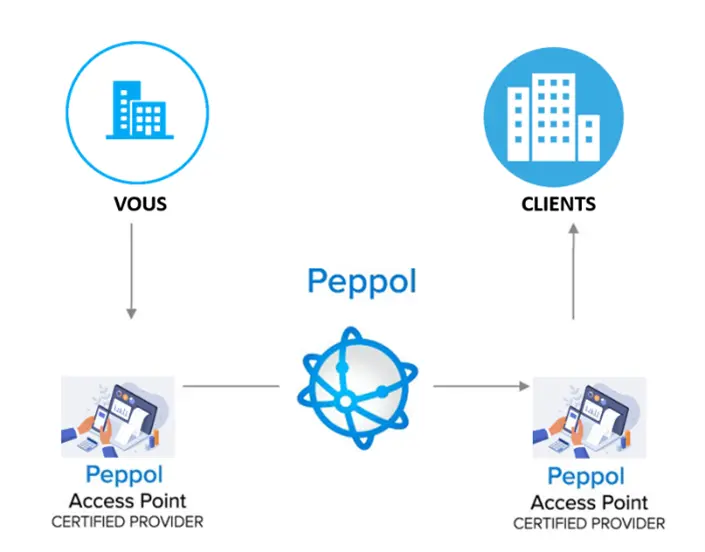

Peppol is a secure and decentralised network through which your electronic invoices to/from customers/suppliers will be transmitted. Peppol is comparable to a telecommunications network where data is transmitted securely.

When you make a call, your phone connects through your provider (Proximus, Orange, Base, etc.) to the global network. The operator (point of access to the global network) of the person you are calling then connects to the global network and puts you in touch.

Peppol will play this role of a global network or rather a European one.

You will therefore need to subscribe to a Peppol access point (equivalent to your telephone operator) in order to send your invoices as well as to receive them.

📧Electronic invoicing? I'm already using it!

The electronic invoice or e-invoice (e-invoicing) is not just a PDF file sent by email. It is an electronic file in a specific format, a specific protocol, and is standardised (UBL file). It can be read and processed by third-party software without error.

🎯What is the purpose of Peppol?

The main aim is to secure all transactions between businesses.

This system will also help to prevent VAT fraud within the European territory.

It will be easier for member states to monitor business transactions thanks to Peppol and the standardised invoice format UBL.

🙋♂️Am I affected by electronic invoicing?

From 1 January 2026, all Belgian companies subject to VAT will be required to use structured electronic invoices for their transactions. This means that invoices must be exchanged directly between the companies' software, and sending invoices in PDF format, by email or via a platform will no longer be sufficient.

If you have an active VAT number, this obligation also applies to your business.

On the other hand, if you only work for private clients, this obligation does not apply to invoices sent to these individuals. However, you will need to be able to receive structured electronic invoices from your suppliers and adapt your systems accordingly before January 2026.

🗝️Summary key points

👨💻 Obligation to issue and receive: Currently, the issuance of electronic invoices is not mandatory in B2B (only in B2G – Business-to-Government). From 1 January 2026, with the obligation for electronic invoicing in B2B, taxable persons will no longer be able to refuse to issue or receive electronic invoices.

📃 Structured e-invoicing: The electronic invoicing in question is a "structured" invoice (UBL), allowing for automatic and electronic processing. The process will be fully automated, and users will be notified by email as soon as a new invoice is available. Word or PDF formats will not be sufficient as they do not allow for automatic and secure processing.

💰Tax incentives: To offset the costs of necessary technical adaptations, two support tax measures have been implemented:

- From 1st January 2025, the deduction for digital investment will be increased to 20%.

- For the taxable periods from 2024 to 2027, small SMEs and freelancers using subscription models will be able to benefit from an increased expense deduction of 120% for invoicing programmes. The additional cost related to the subscription of the existing software for electronic invoicing will be eligible for this deduction, provided it is itemised separately on the invoice.

🚀We are already "Peppol Ready", and you?

🦅At Red & Black Accountancy, we have anticipated this digital transition and we can already issue Peppol electronic invoices to all our clients. We encourage you to contact us as soon as possible to implement this system in order to comply with the obligation that will come into effect in January 2026.

👉How to prepare yourself?

We have been using the Horus software for your accounting since 1st January 2025. This software can be connected to the application Falco, which is a simple and secure solution for electronic invoicing aimed at freelancers and SMEs. We therefore encourage you to use this tool for your invoicing.

With Falco, you benefit from:

✔ An automated accounting system: your purchase invoices are sent directly to our system, without manual handling.

✔ A time saver: no need to scan or email your invoices anymore.

✔ Assured compliance: Falco is PEPPOL certified, ensuring that your invoices comply with the regulations.

✔ A better organisation: your documents are centralised and accessible in just a few clicks.

✔ A reduction in errors and losses: no more lost or incorrectly entered invoices.

📂 More information?info@redblack.be ou au 0473/39.82.93

Anticipate this change now for simplified management!

RED & BLACK ACCOUNTANCY

Kabili Damien